Codebooks (Account assignment and VAT breakdown)

In this section, you can set detailed account assignment segmentation and VAT breakdown for individual items on the document. A more detailed division of items is then copied into the XML export of documents, which can be generated from the Payments / Documents section.

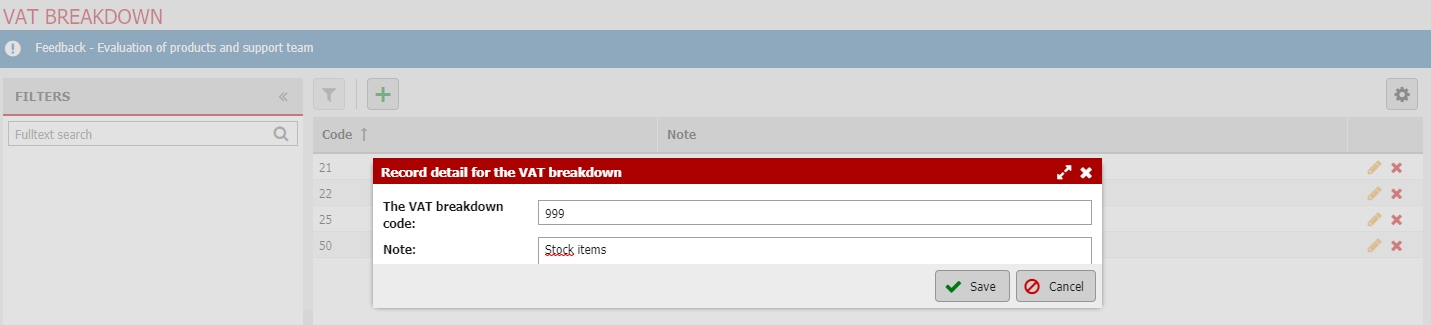

Setting up both modules (Account assignment and VAT breakdown) are basically identical. Create a new category by pressing the green plus button – code for Account assignment / VAT breakdown code including comments related to the given category.

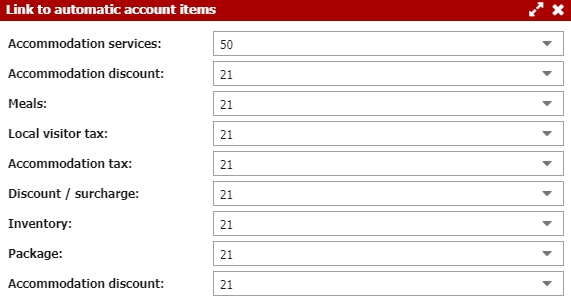

For automatically uploaded items in room account (i.e. accommodation services/fees/meals, etc.), establish a specific code for account assignment or VAT breakdown by using the gear button in the upper right section above the table.

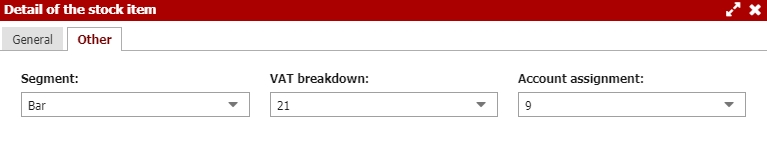

For all other defined items that you can add to the room account – whether it is items from retail sales or services – determine the Account assignment and VAT breakdown category in the settings of the given item (in the “Stock items” or “Services” section). You can find the settings in the “Other” tab while editing a specific item.

After setting the Account assignment/VAT breakdown, individual items have assigned “codes”, which are also copied to exported XML files. Information about detailed segmentation of Account assignment/VAT breakdown is then automatically processed by the accounting software via the import of the XML file.