Filtering and exporting documents

Filtering documents

The left section of the documents contains all the options allowing you to filter documents. Specifically, you can filter according to these parameters:

- Full-text search (guest name, organisation, document number, etc..)

- Range of dates (due date /date of issue/date of taxable supply /closing date/reservation departure date)

- Document payments (paid/unpaid/partially paid)

- Document type (INV/REC/PRI/ADV/CRE/COU)

- Currency of the document (according to the enabled currency profile)

- Method of payment (cash/card payment/bank transfer/voucher)

- EET document status (sent/unsent/sending is pending/cancelled)

- If the document is/is not paired with a booking

- If the document has been credited

- Documents assigned as advances to other documents

- Documents which have other documents assigned as their advances

After selecting the parameters, do not forget to confirm the selection by clicking on the “Search” button in the bottom section of the panel of filters in order for the list of documents to be updated according to the selected parameters.

Exporting documents

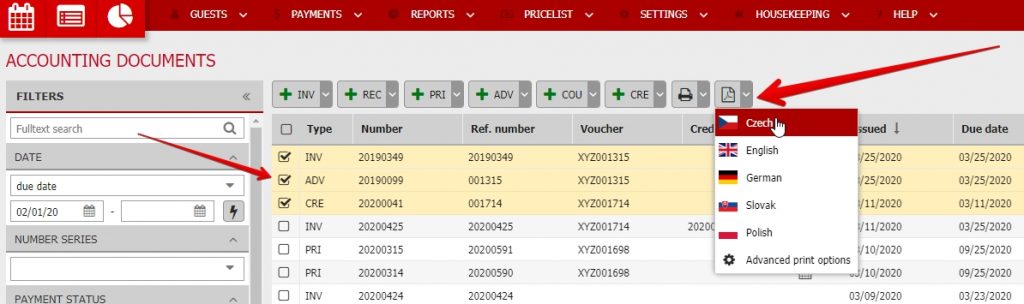

It is possible to export the filtered documents into a PDF or XLS file format by clicking on the printer icon above the list of documents. The PDF summary is a simplified version of the XLS format export, and contains less information. In comparison with the PDF file, the XLS file also includes a breakdown of the individual VAT rates, including totals for individual rates, which are shown on the file’s second page.

Other options include creating a quick summary of totals through the “Summaries” option. Another option is the statement of specific documents according to the items included in the documents.

The last four options serve to export data into accounting software, specifically:

- ISDOC (general document export in ISDOC file format; it should be compatible with most Czech and international accounting software)

- XML for the Pohoda accounting software

- XML for the Money S3 accounting software

- XML for the Quit accounting software

- CSV for the Helios Red accounting software

Once you select the option to export into XML, a window with “unintelligible” code will appear. However, information about the documents are included in this code. All you have to do is right-click wherever on the page and select the “Save as” option. Then you simply import the XML file into your accounting software.

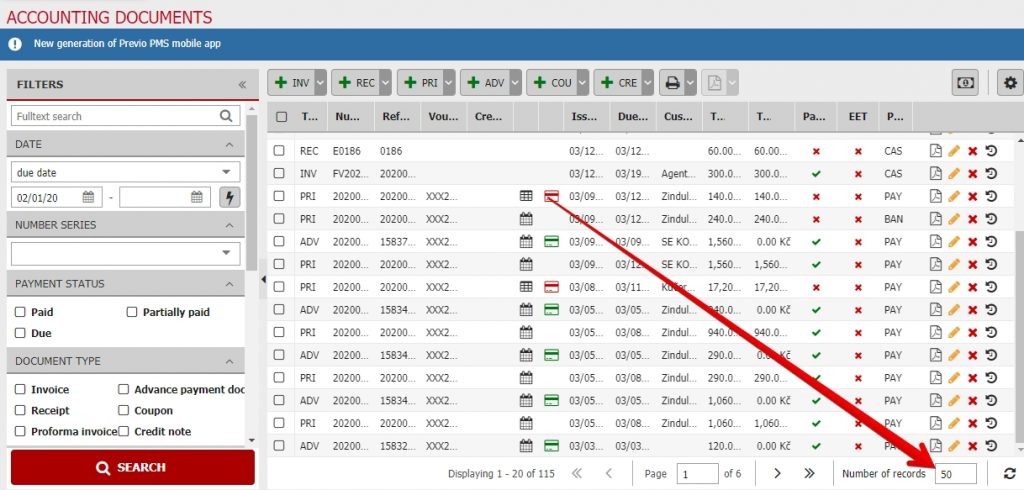

Bulk PDF export

Right next to the mentioned export button with printer icon you have the second export option. It is called Bulk PDF export, long story short you can generate more PDF with documents at once and you do not have to generate them one by one.

First use the filters and search for the documents you are interested in. Then mark the checkbox for documents you want to print/generate to PDFs (or select all documents from page by marking the checkbox in the table header).

ZIP file with selected documents in PDF will be generated and downloaded.

ATTENTION: If your search results have more than one page, you need to export each page separately. ZIP contains only the selected document files from currently displayed page of your search.

Default value is 20 displayed records (documents) per page but you can raise it up to 50. Using the tool in lower right corner of the documents list.