Visitor tax

Start by clicking on the green plus button in the top left corner of the module. This will create a new set of local taxes and exceptions.

Each set of rules can have several parameters /atributes. When you create a new set of rules all rules from previous set are preselected and you can adjust them (because usually most things remain the same and mostly only the local tax value changes).

Validity date

Each set is valid from selected date. This can be useful when you know that from 1st of January 2022 the value of tax will change. You can create a new set of rules starting from 1st of January 2022 right away. New set of rules (value of tax) will apply to all newly created reservations in 2022.

If you create a new set of rules with validity date in between two already created sets, dates of all sets will be automatically adjusted according to the newly created set.

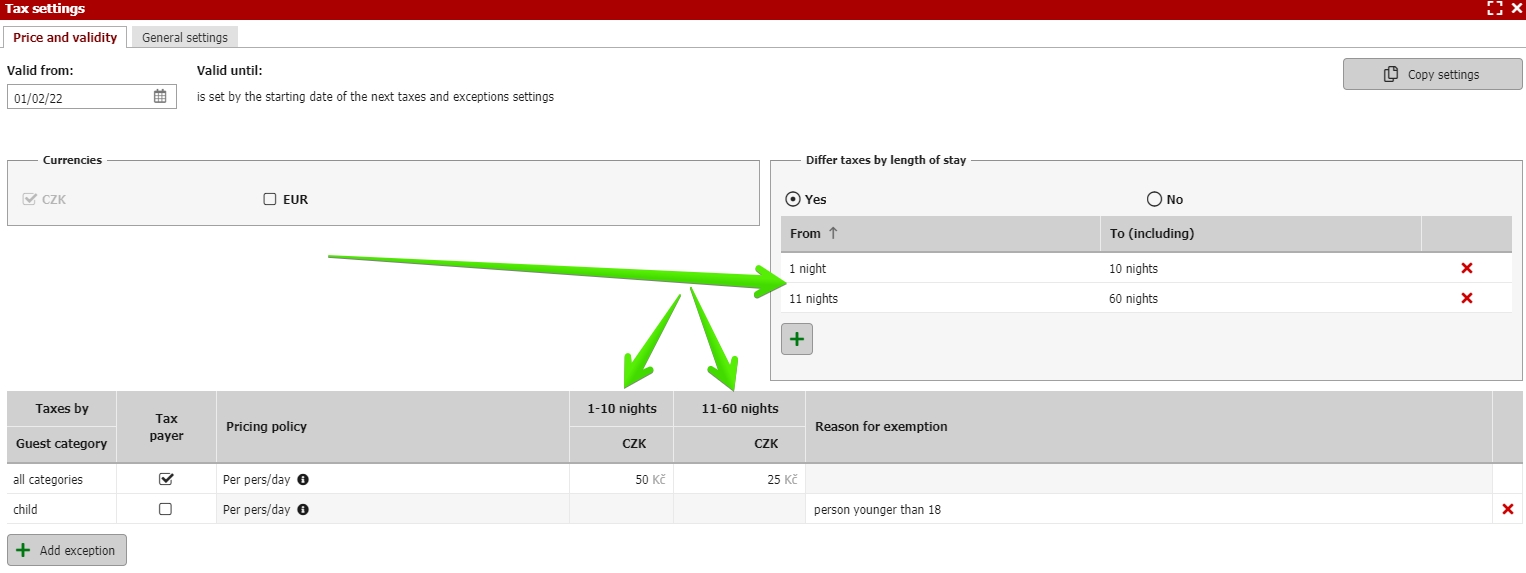

Different local tax based on length of stay

Local tax value and possible exceptions from its payment can be set according to the length of stay.

You will predefine any number of date ranges. Ranges cannot overlap. If you miss some length of stays in the settings these length of stays will be excluded from the local tax.

Each new date range will add one more column to the chart in the lower part of the settings window. Then its possible to set different values of local tax for different lengths of stay or exclude resevations in particular length from paying the local tax.

Our example from the picture above is set like this:

- For 1-10 nights local tax is set to 50 CZK (except the child category, which has an exception).

- For 11-60 nights local tax is only 25 CZK (again except the child category).

- For 61 and more nights we dont have a date range set and therefore for this length of stay local tax is not being calculated.

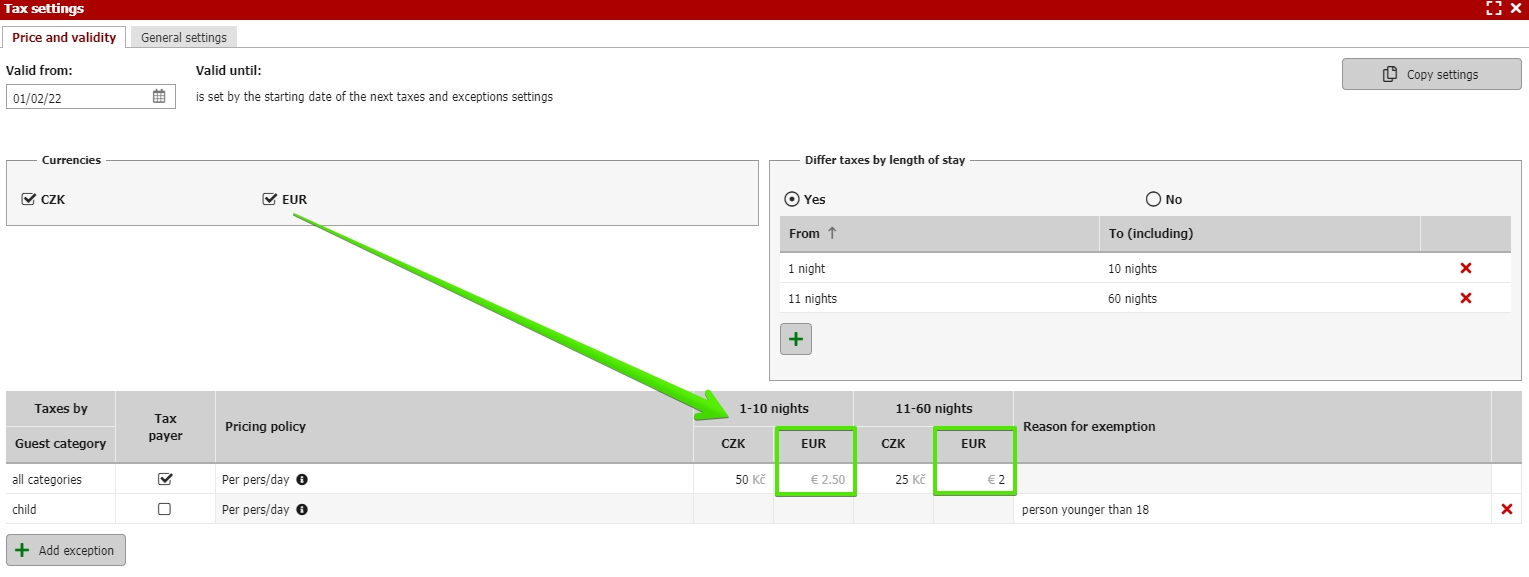

Local taxes in different currencies

Local tax can be also set in different value for different currencies. Local tax value can be set manually or you can calculate the value automatically using the exchange rate.

In the chart all automatically calculated values will be grey and manually inserted black. If you create a reservation in secondary currency (for example USD) local tax will be calculated in set value for particular currency.

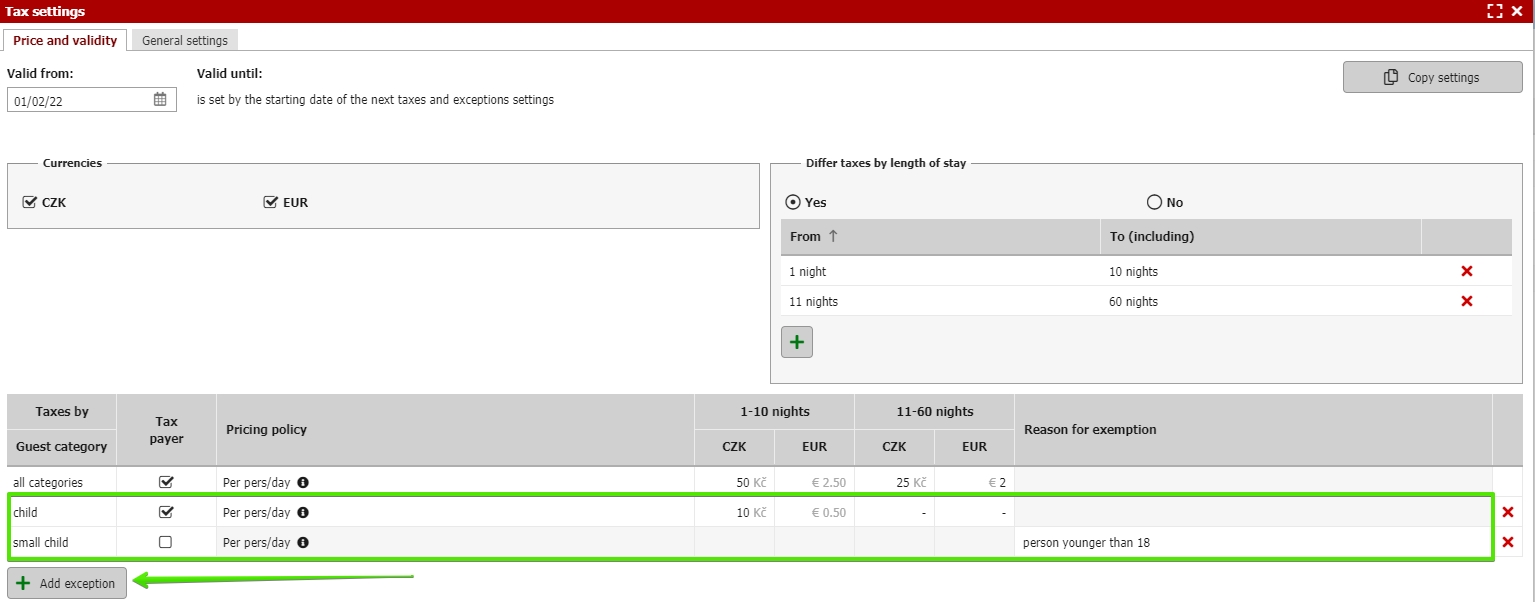

Exceptions for guest categories

In the lower part of the window you can also set exceptions from general settings. Exceptions can be set for special guest categories which do not pay local tax (unmark the checkbox local tax payer) or have a different value of local tax.

In this example our setting is following:

- General rule – local tax is 50 CZK (1-10 nights) a 25 CZK (11-60 nights).

- Exception 1 – child guest category local tax value is 10 CZK (for stays for 1-10 days) and for stays longer than 11 nights the local tax is not being paid.

- Exception 2 – small child category will not pay any local tax for any stays. Reason of exception will be set to “person younger than 18”.

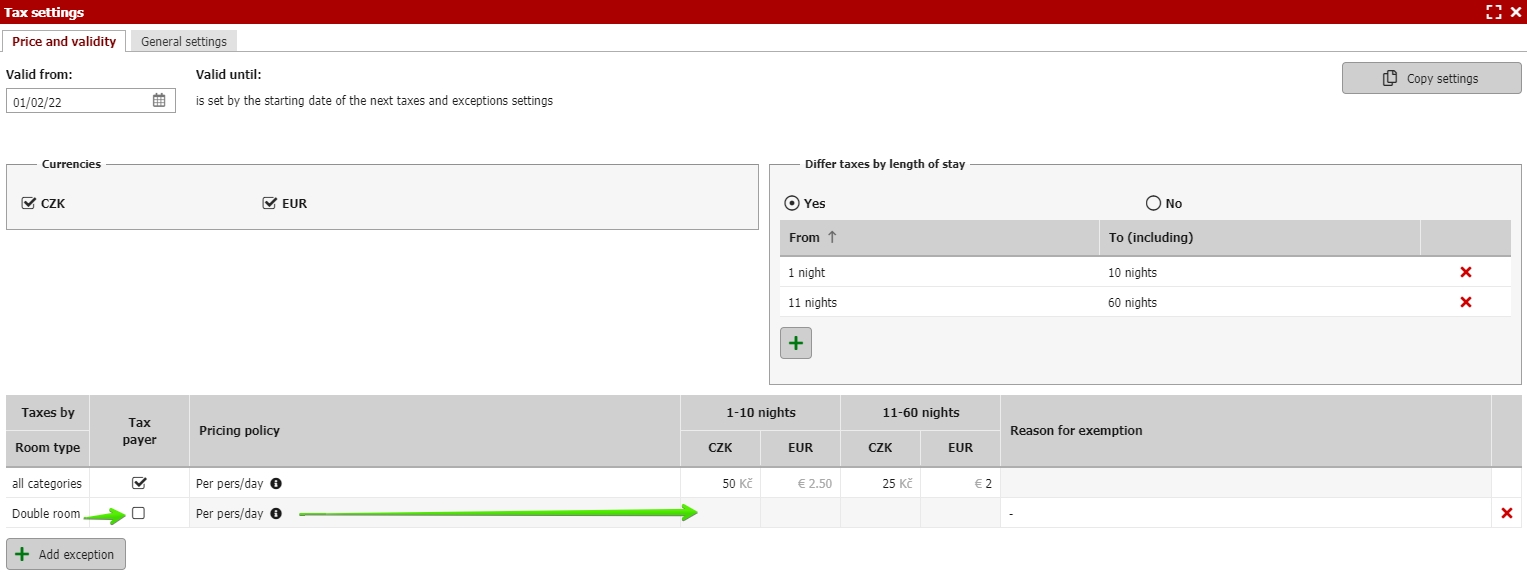

Exception for room category

Similar to guest category exceptions. Click on the “add exception” button and select particular room with different value of local tax.

Our example is following:

- General rule – local tax is set to 50 CZK (1-10 nights) and 25 CZK (11-60 nights).

- Exception 1 – guests staying in “double room” will not pay any local tax.

Exception for guest category can be combined with exception for room. For example you can set exception for seniors staying in double rooms etc. All guest categories, rooms and their combination will follow the general rule different rules for local tax will be applied only for seniors staying in particular double room.

Order of exceptions

There can also be a situation when several different exceptions overlap.

- 1st exception for guest category 10 CZK

- 2nd exception for room type 20 CZK

- 3nd exception for the (same)guest category and (same) room type 30 CZK

We use the most strict condition first. With these three it will be the one for both guest category and room type with 30 CZK value.

In case we have only 1st (10 CZK) and 2nd (20 CZK) exception we will use the one for guest category first (20 CZK).

General settings

There is also the second part of setting in the second tab.

How to charge municipal fee on hotel accounts

- Put on a separate row

- Merge with accommodation services item (local tax will be included in accommodation services item and will not be stand alone item in room account).

We strongly recommend to put local tax on separate row. Local taxes are usually in 0% VAT rate and therefore it is better to keep them separated from accommodation services.

The influence on the resulting accommodation price

- Tax will not affect the total stay price

- Add tax to the accommodation price

Better to show the difference on an example. Our room rate is 100 CZK for 1 night and the local tax is 20 CZK.

With the first option final price will be 100 CZK according to the pricelist. This price already includes the tax, that means that the net accommodation price will be 80 CZK (100-20) + 20 CZK local tax.

For the second option the final price will be 120 CZK. That consists from 100 CZK for accommodation + 20 CZK of local tax.

Accommodation fee influence on final stay package price (similar as above but only for stay packages)

- Tax will affect the stay package price

- Add tax to stay package price

Stay package can include the local tax or with the second option local tax will be added as extra item and its value will be added to the set price of stay package.