Visitor tax

In this section you can create reports for accommodation fees for the city hall. The accommodation fee is payable for all guests for each day of accommodation.

The amount of the individual fees and the exempted guest categories may vary — it is always determined by local regulation. You can set the fee amounts in the Prices / Visitor tax menu.

Similarly, like for reports for the statistical authority, the calculation of the total amount of fees is based either on bookings from the Reservation calendar or, as the case may be, on a generated report from the Guest book. The charges then are summed up for all persons in bookings that fall into the “tax required” category and are due to pay the accommodation tax.

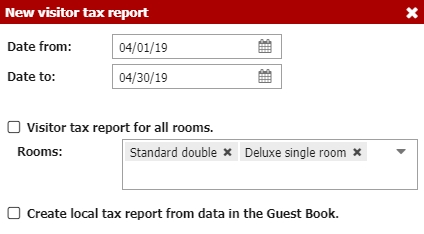

Report can be also created only for selected room types. This comes to hand if you have multiple apartments at different addresses listed in one Previo profile and you need to report the taxes separately one by one.

In addition to a summary fee report, certain municipalities occasionally require the listing of guests who were accommodated at a certain time period for which the fees were collected. You can generate such a list easily either from the hotel guest book or filter it from the guest database for a certain time period.

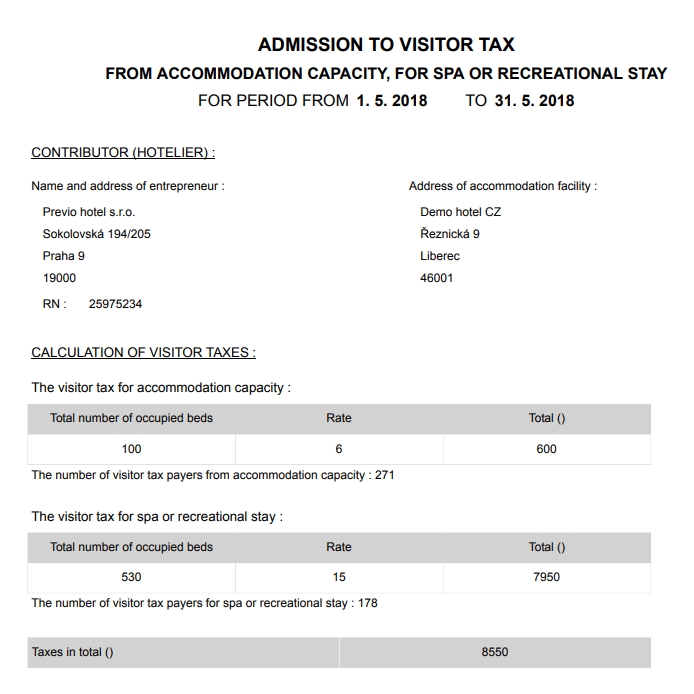

The fee list finally looks something like this (whereby it is again possible to edit individual numbers):

After clicking on the print icon, you have the option to generate the following:

- Accommodation fees by days

- Visitor’s tax by rooms

- Summary fee report (see the print screen above)